What is a 30-year fixed rate mortgage?

A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The interest rate charged on the outstanding principal balance does not change month to month, guaranteeing a stable payment plan.

Mortgage interest rates today are constantly fluctuating and providing new opportunities for prospective homebuyers to jump into the real estate market. When interest rates are low, demand for 30-year mortgages rates spikes. Homebuyers know that if they can strike while the iron is hot, they’ll secure financing for a new home at a low interest rate that will never change No matter how the economy or the real estate market evolves throughout the three decades of the loan’s term, the interest on fixed rate mortgages remains steady.

Opting for this loan structure means that 30-year mortgage rates today will not change for the full term of the loan. While some other mortgage structures adapt to current interest rates, the amount of interest on a fixed mortgage won’t budge. This certainty allows you to plan for your financial future without the risk of unexpected economic conditions impacting your mortgage payments.

Since these payment plans are spread over three decades, the amount paid each month is less compared to other shorter-term mortgages. A 15-year fixed rate mortgage, for example, gives you much less time to repay the loan. To make up for this shortened schedule, your monthly payments on a 15-year mortgage would be higher than if the plan was spread over 30 years.

Let’s take a closer look at interest and how it plays into 30-year mortgage rates.

30-year fixed rate mortgages and interest

While researching 30-year fixed mortgage rates, you’ll notice that the loan’s interest weighs heavily on your borrowing limits and repayment minimums. Calculated as a percentage of the full mortgage loan, the interest rate outlines the annual cost of financing a home purchase. Charging interest on a loan is a lender’s way of ensuring returns by mitigating some of the uncertainty around issuing a mortgage while giving the lender a return on the money that was lent.

As is the case with all mortgage loans, your initial payments will be largely devoted towards paying the interest due on the outstanding principal balance. You shouldn’t expect to gain much equity in the home during your first few years living there. Lenders will usually recommend that borrowers opt for a 30-year mortgage only if they plan on staying in the home for a long period of time.

Living on the property for only five years or less may be long enough to pay the interest due on the outstanding principal balance, but the loan balance itself will not have made much progress. Since you haven’t paid off a significant amount of the principal, you haven’t gained much equity in the property. This means that selling the home after only five years likely won’t allow you to profit from your real estate investment.

Even though your first few years will largely be spent paying the interest due on the outstanding principal balance on the loan, you’ll gradually start to increase the amount paid towards the loan’s principal. During the latter half of your lending agreement, you’ll gain more equity with each monthly mortgage payment as the remaining balance on your loan dwindles.

Before applying for a 30-year fixed rate mortgage you’ll need to decide how much interest you’re willing to pay. Interest on a 20-year mortgage, for example, is likely lower. This provides an opportunity to build equity at a faster pace while saving you thousands in interest once the loan is closed. However, monthly minimums on shorter-term loans are much higher, making 30-year mortgages much more affordable on a month to month basis.

What is the difference between interest rate and APR?

Another important figure you’ll come across while shopping for 30-year mortgage rates is the annual percentage rate or “APR.”

Not to be confused with interest, the APR is also expressed as a percentage of the overall loan amount. However, rather than signifying the annual cost of a mortgage, the APR outlines the amount to be paid each year in home loan expenses, factoring in the loan’s cost at the time of closing plus what you’ve paid in interest over the life of the mortgage.

Developed as a way to provide accurate and transparent mortgage information to buyers, the APR lays out where your scheduled payments are going and allows consumers to compare loan scenarios from various lenders and understand who is really offering the best deal.

A home sale’s closing costs, mortgage insurance and loan origination fees all factor into the APR, providing the buyer with an overview of what they are paying month after month. As a part of the Federal Truth in Lending Act, lenders must disclose accurate APRs before the loan is finalized. This gives prospective buyers a solid basis for comparing their home buying options. For a better look at how your 30-year mortgage will be paid off over time, your lender will provide an amortization schedule.

What is an amortization schedule?

A major advantage of a 30-year fixed mortgage is the security in knowing exactly how much you’ll be paying each month. The ability to predict your largest expense for up to the next 30 years provides a huge advantage in financial planning. Not only can you accurately predict the amount going towards your mortgage, but you’ll also know how much you’ll have left over to contribute towards other investments and savings accounts.

This predictability allows lenders to build a repayment plan known as an amortization schedule. Amortization refers to the process of steadily paying off a debt through regular payments over a period of time. For a fixed rate mortgage, building an amortization schedule is much simpler thanks to the locked-in interest rate and monthly minimum.

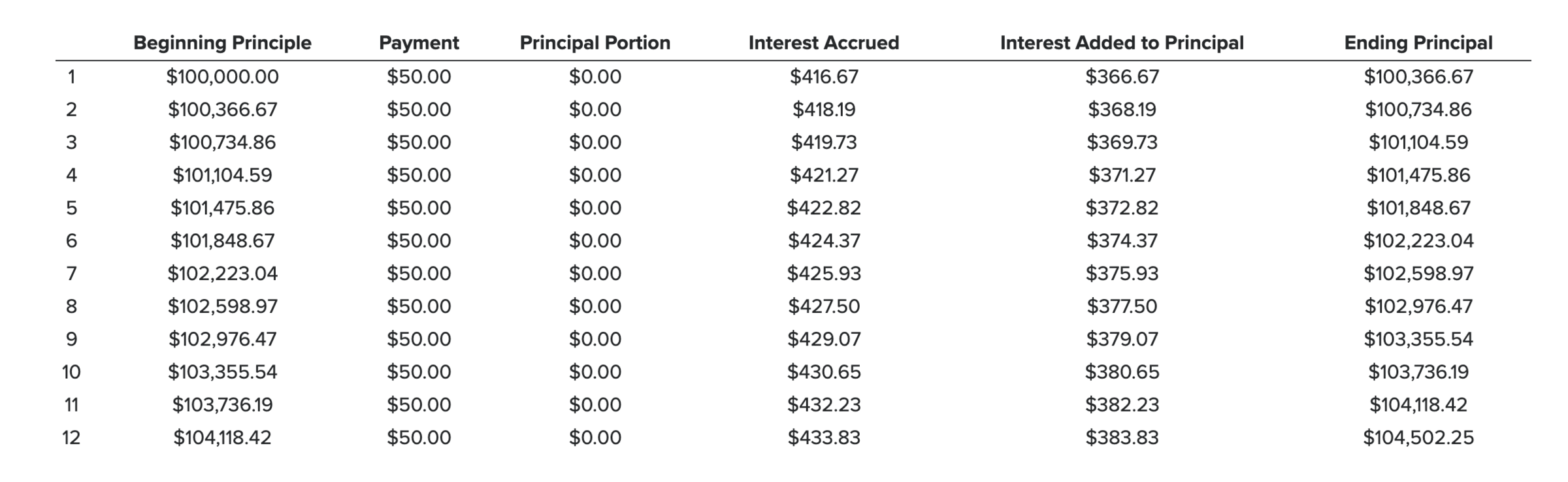

Here’s an example of what an amortization schedule looks like from investinganswers.com.

The amortization schedule, provided by the lender when shopping for a loan, projects your monthly payments throughout the term of the mortgage. This chart also gives a precise estimate of how much equity you’ll have gained in a given month. With this knowledge, you can get a head start on your long-term financial goals and prioritize savings years in advance.

Amortization schedules are a great resource when taking out a fixed rate loan, but become much more complicated when applying for an adjustable rate mortgage.

What’s the difference between fixed rate and adjustable rate mortgages?

Unlike a 30-year fixed rate mortgage, adjustable rate mortgages (ARMs) come with a fluctuating interest rate that rises or lowers along with market conditions.

Minimum monthly payments on these loans depend on external factors, and opting for this mortgage type is usually seen as a greater risk. When mortgage interest rates go up, so do the monthly payments on an ARM.

Homeowners can’t control the economy or shift the real estate market. If you apply for an ARM and these factors turn against your favor, you could end up paying thousands more in added interest after the ARM expires.

This also makes it difficult to predict how much money you’ll have for other expenses down the line. If the amount of interest suddenly spikes after your 5-year or 7-year ARM adjusts, you’ll have to adjust your finances. This makes ARMs a much more volatile lending option than 30-year fixed rate mortgages.

The major advantage of an adjustable rate mortgage is that you could end up saving money over time. The initial interest rates on these loans are typically lower than their fixed rate counterparts. If the mortgage rates continue to dip after the fixed rate period on your ARM expires and your rate adjusts, your rate could decrease even further, lowering your monthly mortgage payments.

Again, this depends entirely on the state of the economy and market trends. In addition to paying a steady rate of interest, 30-year fixed rate mortgages offer a number of financial advantages.

Knowledge Center Terms of Use Licensing Info Disclaimer Legal Privacy Policies SMS Terms Accessibility Notice To Vendor Careers

Copyright © 2020-2024 Proper Rate, LLC. All rights reserved.

Equal Housing Lender

Proper Rate NMLS: 1901699 - For licensing information, go to: www.nmlsconsumeraccess.org.

1800 W. Larchmont Ave., Suite 301, Chicago, IL 60613

Proper Rate NMLS - 1901699

Arizona Mortgage Banker License #1010230

P: 866-755-0679 *not for use by New York borrowers

Texas consumers: How to file a complaint

This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site.

Proper Rate, LLC. is an Equal Opportunity Employer that welcomes and encourages all applicants to apply regardless of age, race, sex, religion, color, national origin, disability, veteran status, sexual orientation, gender identity and/or expression, marital or parental status, ancestry, citizenship status, pregnancy or other reason prohibited by law.